2 books by Alvarez, Anthony S

Credit Where It's Due

Rethinking Financial Citizenship

Frederick F. Wherry

Russell Sage Foundation, 2019

An estimated 45 million adults in the U.S. lack a credit score at time when credit invisibility can reduce one’s ability to rent a home, find employment, or secure a mortgage or loan. As a result, individuals without credit—who are disproportionately African American and Latino—often lead separate and unequal financial lives. Yet, as sociologists and public policy experts Frederick Wherry, Kristin Seefeldt, and Anthony Alvarez argue, many people who are not recognized within the financial system engage in behaviors that indicate their credit worthiness. How might institutions acknowledge these practices and help these people emerge from the financial shadows? In Credit Where It’s Due, the authors evaluate an innovative model of credit-building and advocate for a new understanding of financial citizenship, or participation in a financial system that fosters social belonging, dignity, and respect.

Wherry, Seefeldt, and Alvarez tell the story of the Mission Asset Fund, a San Francisco-based organization that assists mostly low- and moderate-income people of color with building credit. The Mission Asset Fund facilitates zero-interest lending circles, which have been practiced by generations of immigrants, but have gone largely unrecognized by mainstream financial institutions. Participants decide how the circles are run and how they will use their loans, and the organization reports their clients’ lending activity to credit bureaus. As the authors show, this system not only helps clients build credit, but also allows them to manage debt with dignity, have some say in the creation of financial products, and reaffirm their sense of social membership. The authors delve into the history of racial wealth inequality in the U.S. to show that for many black and Latino households, credit invisibility is not simply a matter of individual choices or inadequate financial education. Rather, financial marginalization is the result of historical policies that enabled predatory lending, discriminatory banking and housing practices, and the rollback of regulatory protections for first-time homeowners.

To rectify these inequalities, the authors propose common sense regulations to protect consumers from abuse alongside new initiatives that provide seed capital for every child, create affordable short-term loans, and ensure that financial institutions treat low- and moderate-income clients with equal respect. By situating the successes of the Mission Asset Fund in the larger history of credit and debt, Credit Where It’s Due shows how to prioritize financial citizenship for all.

Wherry, Seefeldt, and Alvarez tell the story of the Mission Asset Fund, a San Francisco-based organization that assists mostly low- and moderate-income people of color with building credit. The Mission Asset Fund facilitates zero-interest lending circles, which have been practiced by generations of immigrants, but have gone largely unrecognized by mainstream financial institutions. Participants decide how the circles are run and how they will use their loans, and the organization reports their clients’ lending activity to credit bureaus. As the authors show, this system not only helps clients build credit, but also allows them to manage debt with dignity, have some say in the creation of financial products, and reaffirm their sense of social membership. The authors delve into the history of racial wealth inequality in the U.S. to show that for many black and Latino households, credit invisibility is not simply a matter of individual choices or inadequate financial education. Rather, financial marginalization is the result of historical policies that enabled predatory lending, discriminatory banking and housing practices, and the rollback of regulatory protections for first-time homeowners.

To rectify these inequalities, the authors propose common sense regulations to protect consumers from abuse alongside new initiatives that provide seed capital for every child, create affordable short-term loans, and ensure that financial institutions treat low- and moderate-income clients with equal respect. By situating the successes of the Mission Asset Fund in the larger history of credit and debt, Credit Where It’s Due shows how to prioritize financial citizenship for all.

[more]

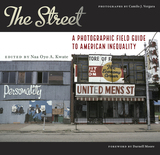

The Street

A Photographic Field Guide to American Inequality

Naa Oyo A. Kwate

Rutgers University Press, 2021

Vacant lots. Historic buildings overgrown with weeds. Walls and alleyways covered with graffiti. These are sights associated with countless inner-city neighborhoods in America, and yet many viewers have trouble getting beyond the surface of such images, whether they are denigrating them as signs of a dangerous ghetto or romanticizing them as traits of a beautiful ruined landscape. The Street: A Field Guide to Inequality provides readers with the critical tools they need to go beyond such superficial interpretations of urban decay.

Using MacArthur fellow Camilo José Vergara’s intimate street photographs of Camden, New Jersey as reference points, the essays in this collection analyze these images within the context of troubled histories and misguided policies that have exacerbated racial and economic inequalities. Rather than blaming Camden’s residents for the blighted urban landscape, the multidisciplinary array of scholars contributing to this guide reveal the oppressive structures and institutional failures that have led the city to this condition. Tackling topics such as race and law enforcement, gentrification, food deserts, urban aesthetics, credit markets, health care, childcare, and schooling, the contributors challenge conventional thinking about what we should observe when looking at neighborhoods.

Using MacArthur fellow Camilo José Vergara’s intimate street photographs of Camden, New Jersey as reference points, the essays in this collection analyze these images within the context of troubled histories and misguided policies that have exacerbated racial and economic inequalities. Rather than blaming Camden’s residents for the blighted urban landscape, the multidisciplinary array of scholars contributing to this guide reveal the oppressive structures and institutional failures that have led the city to this condition. Tackling topics such as race and law enforcement, gentrification, food deserts, urban aesthetics, credit markets, health care, childcare, and schooling, the contributors challenge conventional thinking about what we should observe when looking at neighborhoods.

[more]

READERS

Browse our collection.

PUBLISHERS

See BiblioVault's publisher services.

STUDENT SERVICES

Files for college accessibility offices.

UChicago Accessibility Resources

home | accessibility | search | about | contact us

BiblioVault ® 2001 - 2024

The University of Chicago Press